Alphaledger Investment Management Forecast

Stay long and continue to buy the dips as good inflation for stocks should move higher into October, driven by contained energy prices and lag effects of tariffs creeping in. Growth tailwinds continue to be AI investment, deregulation and contained unemployment.

Commentary

- U. S. Treasury yields finished the quarter lower with the UST 2Y at 3.6% and 10Y at 4.15%. Key themes that drove the markets were Dollar down, Stocks up and Gold up.

- Gold futures strategy was added to the T12 portfolio 8/13/25, right before it took off in September.

- 70% of T12 was correlated to equity returns by investing in barrier put strategies, selling VIX futures premium and bullish call spreads.

- Target gross distribution rate was achieved for the quarter. After fees, the current annualized distribution rate was 11.11% of NAV as of 9/30/25.

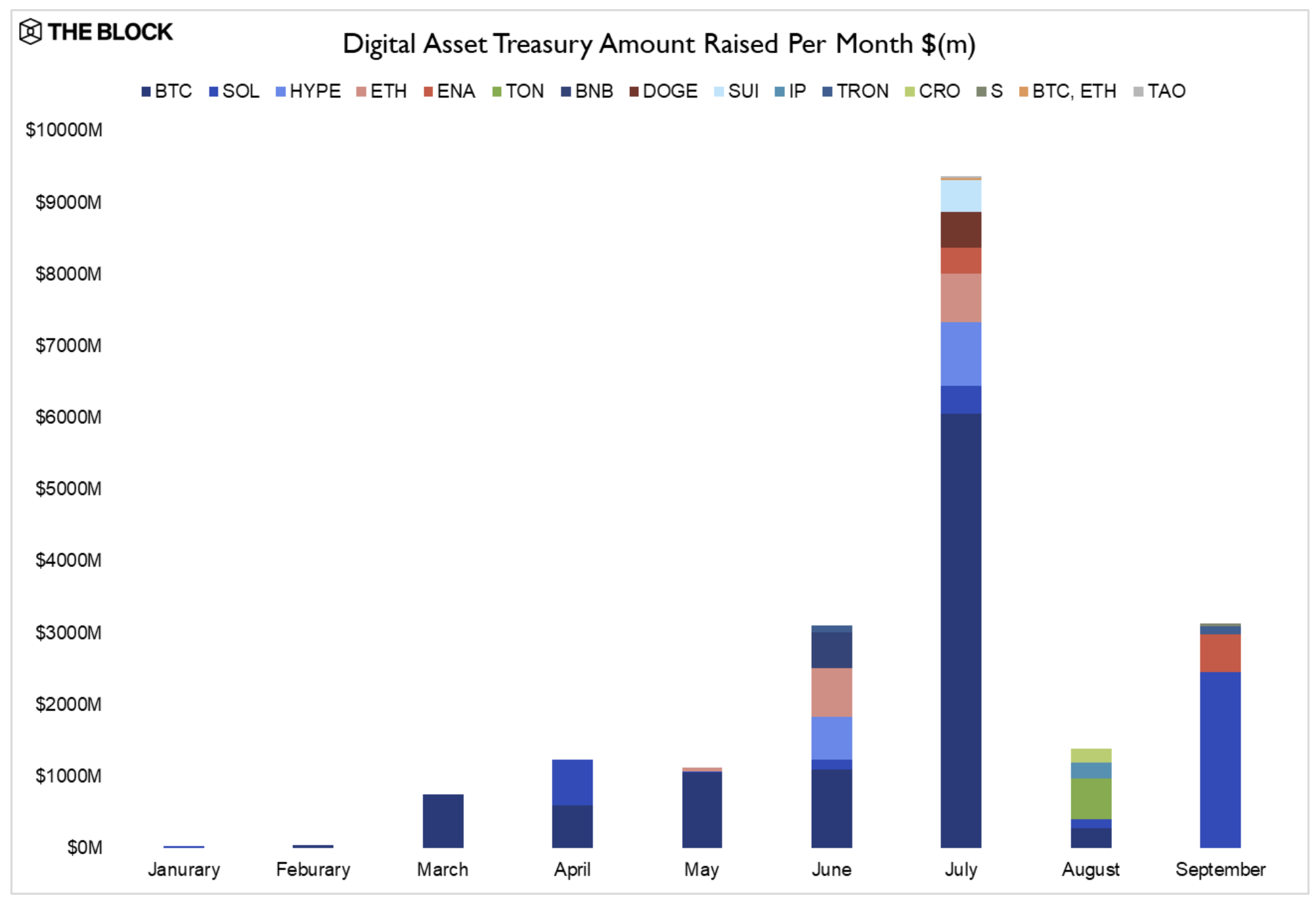

Crypto Corner

DAT money grab peaked in July. Will we see a new high or is the top in?

Risk-Free Treasury Yield is a Misnomer / Why T12

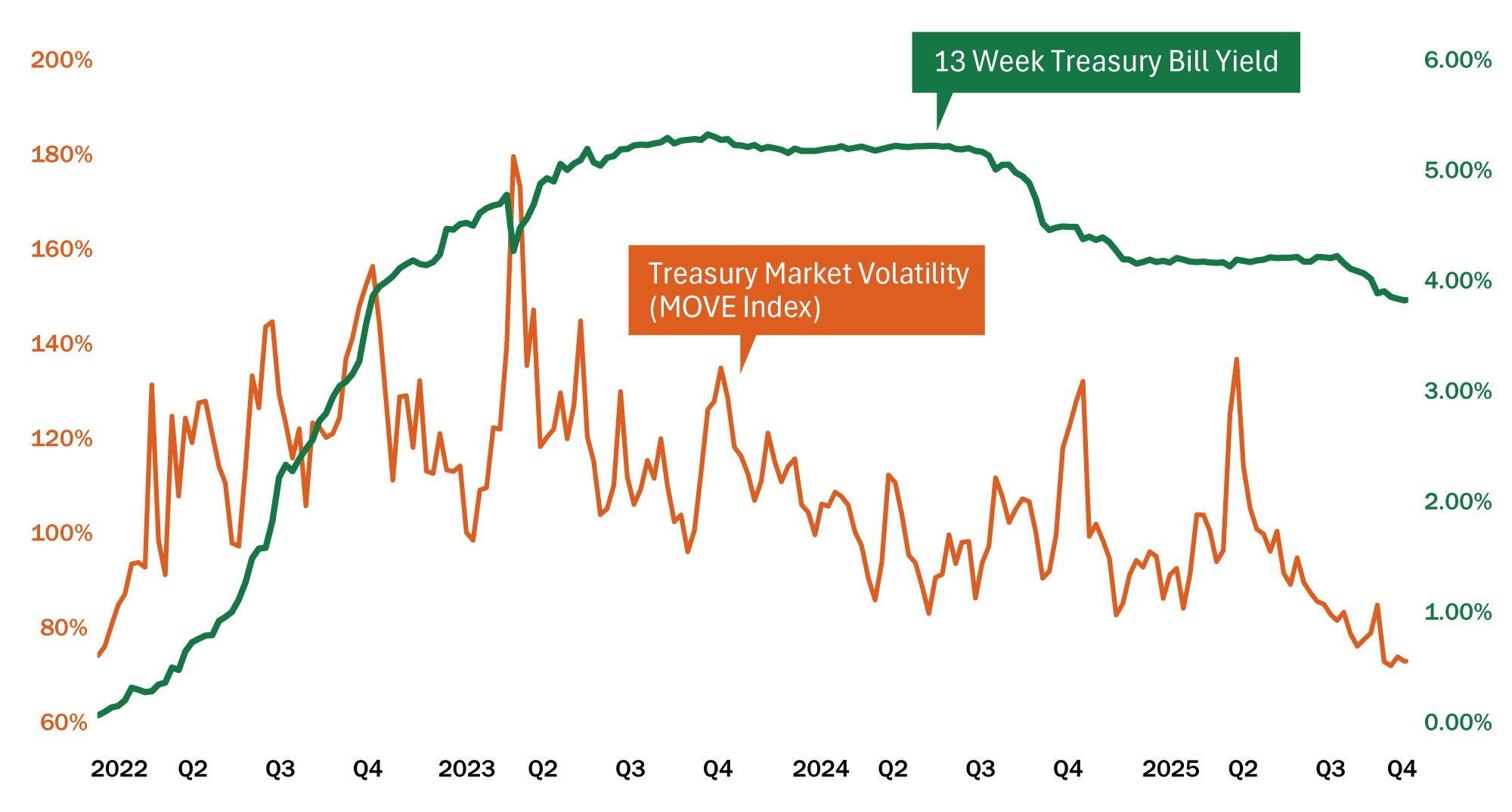

- Institutions and retail investors in search of yield face new risks in fixed income not seen in the previous 3 decades.

- Yields are under pressure due to monetary policy and yield curve normalization.

- Equity like volatility spikes have been occurring in the bond market since 2022

- Tactical allocation between asset classes and generating additional income in new ways on Gold, Stocks and even Treasuries address these concerns.