Introduction

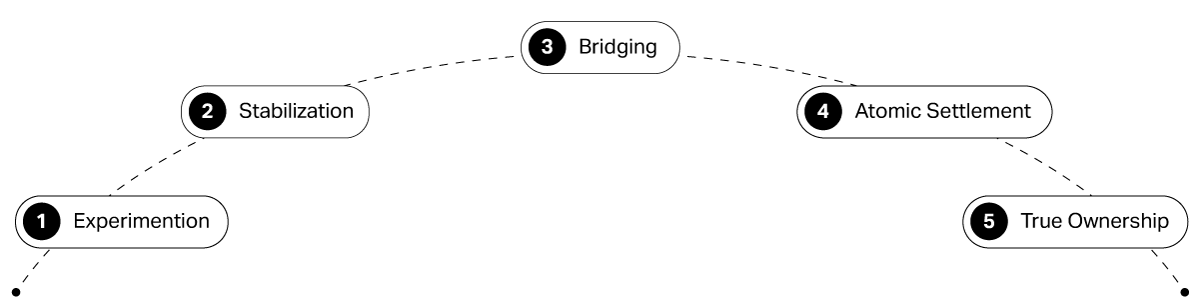

The tokenization of regulated assets — stocks, bonds, ETFs, alternative investments and other securities — marks a fundamental transformation in how capital markets operate. At Alphaledger, we believe this transformation follows a clear, five‑phase journey — the “Arc of Regulated Asset Tokenization” — that guides traditional assets onto blockchain networks while respecting the guardrails of securities law. In this paper, we weave those phases into a single narrative that shows how tokenization evolves from bold experimentation to true, on‑chain ownership.

From Frontier Experiments to Institutional Adoption

PHASE 1: THE WILD FRONTIER

Tokenization was born in the crucible of decentralized finance, when pioneers, driven by little more than curiosity and ambition, deployed smart contracts on permissionless blockchains. They minted tokens, engineered nascent lending protocols, and launched decentralized exchanges. Public chains like Ethereum demonstrated a powerful compounding effect: every new dApp, project, or token built on the network amplified the value of the original token, creating a virtuous cycle of innovation.

But this frontier also attracted excess. Meme coins, speculative “grifts”, and extreme volatility recalled the panics of early stock markets — 1907’s bank runs and the 1929 crash. In the spirit of Winston Churchill who famously stated, “never let a good crisis go to waste”, the ecosystem evolved. Just as those TradFi crises ultimately spawned modern clearinghouses, deposit insurance, and robust regulation, the chaos in Phase 1 sparked a wave of technological hardening and the first serious conversations with regulators.

PHASE 2: BUILDING STABILITY

In Phase 2, the industry shifted from wild experimentation toward stability and institutional rigor. Building on the lessons of Phase 1, developers and early adopters hardened smart‑contract protocols, established clear governance frameworks, and integrated on‑chain products with traditional custody and compliance systems. Stablecoins evolved into reliable cash‑management instruments, liquidity pools adopted risk‑controls familiar to money‑market funds, and regulators began pilot programs to validate blockchain’s record‑keeping integrity. This maturation laid the groundwork for a robust financial ecosystem, one in which on‑chain assets could be valued, audited, and trusted just as off‑chain securities are today.

Despite the stabilization, legacy institutions in Phase 2 continued to dismiss the on-chain revolution unfolding around them — just as bond houses once hesitated while Bill Gross rewrote the rules of fixed income trading.

The Turning Point: Real‑World Assets On-Chain

PHASE 3: UNLOCKING TOKENIZED ASSETS

We stand at a critical inflection point, moving beyond experimentation to unlock the true utility of tokenized assets. In this third phase of financial evolution, stocks, bonds, and funds are seamlessly tokenized on public blockchains, marrying the stability of traditional finance (TradFi) with the transformative innovation of the crypto era. This convergence delivers unprecedented value to investors, offering a compelling blend of attractive yields, flexible custodial models, and accelerating regulatory clarity — thus setting the stage for a new era of on-chain investing.

Tokenized assets bridge the gap between the low returns of ultra-safe investments and the high volatility of crypto markets, addressing what we call the “missing middle.” Unlike tokenized money-market funds that mimic treasuries or speculative crypto plays that court excessive risk, this next generation of assets — exemplified by Alphaledger’s T12 Fund — aims to deliver a balanced risk-return profile previously unavailable on-chain. By targeting yields that outpace treasuries while approaching the upside of crypto investments, these assets offer investors a compelling alternative, combining stability with the potential for enhanced returns in a single, accessible package.

To ensure investor choice without compromising security or compliance, tokenized assets support multiple custodial models. Self-hosted multi-party computation (MPC) wallets empower users with direct control, while custodial wallets and traditional custodian models provide familiar options. This flexibility caters to diverse investor preferences — whether crypto-native or TradFi-focused — while upholding the rigorous standards required for on-chain assets. By integrating these models, platforms like Alphaledger ensure that security and compliance remain paramount, fostering trust in the tokenized ecosystem.

Fueling this transformation is a rapidly evolving regulatory landscape. Over the past 12 months, both the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have signaled a progressive shift, expressing support for tokenization projects. This momentum has paved the way for no-action letters and pilot programs that embed investor protection directly into blockchain protocols. As regulatory clarity accelerates, the conditions are set for tokenized assets to scale, offering a compliant, transparent framework that aligns with the needs of investors and regulators alike. Together, these advancements herald a future where tokenized assets redefine wealth creation, delivering both accessibility and stability on public blockchains.

The New Settlement Standard

PHASE 4: ATOMIC SETTLEMENTS

Traditional markets settle on a T+1 or T+2 cadence, relying on intermediaries and netting systems to exchange securities for cash. Blockchain’s promise is “T‑Now™” — instant, atomic settlement with absolute finality. By embedding Delivery‑Versus‑Payment directly into smart contracts, tokenization eliminates counterparty risk and unlocks novel use cases — like practical, intra‑day repo markets that optimize liquidity in real time.

Even as fiat off‑ramps persist, emerging bank‑issued and sovereign stablecoins will blur the line between on‑chain and traditional capital flows. The result: a settlement layer that is faster, safer and more adaptable than anything before it.

The Endgame: Dominium – True On‑Chain Ownership

PHASE 5: DOMINIUM

The ultimate vision of the Arc is a world we call Dominium — where “the street has no name.” Instead of holding securities in a broker’s “street‑name” omnibus account, investors register tokens directly in their own wallets. Self‑custody and MPC/TSS‑enabled wallets become the new bank and brokerage accounts. Assets — from equities to real estate to intellectual property — are universally accessible, programmable, and capable of serving as on‑chain collateral.

In Dominium, financial power shifts from centralized institutions to individuals. No paper, no omnibus accounts, no legacy ledgers — just direct, cryptographic proof of ownership.

Conclusion

Innovation rarely follows a straight line. The Arc of Regulated Asset Tokenization charts a deliberate path: Phase 1’s experimentation, Phase 2’s stabilization, Phase 3’s real‑world bridging, Phase 4’s atomic finality and Phase 5’s true on‑chain ownership. Each phase reduces reliance on traditional intermediaries while layering fresh capabilities that reshape markets. Regulators and legislators are already rewriting the rulebook. Institutions that embrace this journey will define the next era of finance; those that wait risk obsolescence.