Fund Performance

| Rate of Return (Net) | |

|---|---|

| Year to Date (3/6/2026) | 2.65% |

| Inception to Date (3/6/2026) | 9.32% |

| Distributions as of 12/31/2025 | |

|---|---|

| Current Distribution (per unit) | $0.2876 |

| NAV Distribution Rate* | 11.11% |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s units, when redeemed, may be worth more or less than their original cost. Fund inception date is 6/26/2025.

T12 Rate of Return (Net)

Rate of Return (Net): The rate of return represents the percentage change in the fund's net asset value (NAV) per share over the specified measurement period. It is calculated by comparing the beginning NAV per share a the start of the period and the ending NAV per share at the end of the period, adjusted for distributions made during the period.

● Fund Details

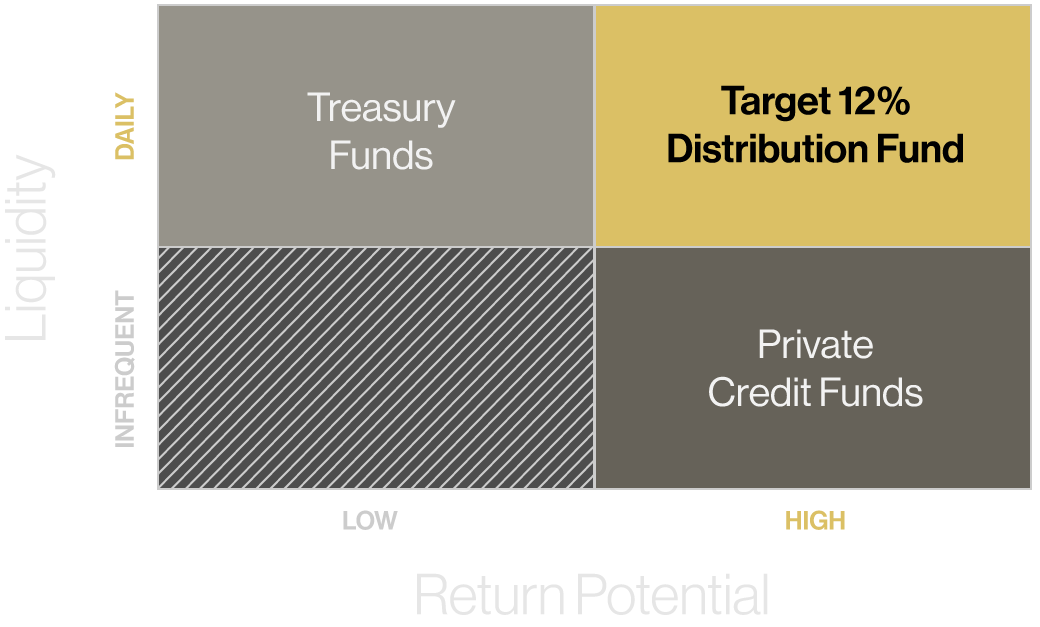

Daily Liquidity and

High Return Potential

| Target Distribution Rate ** | 12% (Annualized, before fees and expenses) |

| Investment Manager | Alphaledger Investment Management, LLC |

| Sub-Advisor | Simplify Asset Management, Inc. |

| Distribution Frequency | Quarterly |

| Offering | Continuous Reg D / 506(c) |

| Investor Eligibility | U.S. Only, Accredited Investors |

| Schedule K-1 | Yes |

| Minimum Investment | $50,000 |

| Liquidity | Daily (subject to limits; U.S. trading days only) |

| Value Transfer | USD or Stablecoin (USDC) |

| Fees | 1% all-inclusive |

| Tokenization Engine | Vulcan Forge by Alphaledger Technologies, Inc. |

| Network | Exclusively on Solana |

Information displayed above is provided for informational purposes only and is subject to change without notice.

T12 Holdings

As of 2/27/2026

Source: Simplify Asset Management

Investment Use Cases

Given its dynamic and diversified income approach, the Fund’s strategy presents several potential applications for a wide range of investors:

Income Generation

Income Generation

The Fund may be a useful tool for accredited investors seeking a potentially high-yielding income stream to supplement retirement or ongoing cash flow needs. Daily liquidity further allows investors to adjust positions as their financial circumstances evolve.

Institutional Allocation

Institutional Allocation

Institutional investors may find the Fund appealing as a diversifying set of risks. Its blend of high-yield, low-duration fixed income, hedged credit, and option strategies may provide a differentiated tool for income generation while managing risk.

Portfolio Diversification

Portfolio Diversification

The Fund offers exposure to actively managed, alternative income-generating strategies that are distinct from traditional bonds, stocks, and cryptocurrencies. This diversification can help reduce overall portfolio volatility and improve risk-adjusted returns.

Digital Asset Integration

Digital Asset Integration

As a tokenized private investment fund, it offers enhanced transparency, streamlined access, and innovative liquidity solutions. This may make it an attractive option for investors looking to leverage blockchain technology while accessing alternative income strategies.

* Distribution Rate: Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s units, when redeemed, may be worth more or less than their original cost. The Distribution Rate is the annual rate an investor would receive if the most recently declared distribution, which includes option income, remained the same going forward. The Distribution Rate is calculated by multiplying the Fund’s most recent distribution as a percentage of NAV by four (4). The Distribution Rate represents a single distribution from the Fund and does not represent its total return.

** The Target Distribution Rate represents the distribution target used for measurement or comparison purposes and only as a guideline for investors to evaluate the Fund’s investment strategies and accompanying information. Distributions are not intended to be actual performance and should not be relied upon as an indication of actual or future performance of the Fund. Subscription and redemption requests are subject to the Fund’s governing documents, cut-off times, and approval by the Investment Manager. Minimum initial and subsequent investments apply.

The information contained herein is solely informational and does not constitute an offer or solicitation for the purchase or sale of investments or investment strategies. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Such an offer may only be made after you have received applicable offering documents for the fund. All of the information herein is subject to, and qualified in its entirety by, the terms described in the fund's offering documents. Before you make an investment in the fund, you should carefully and thoroughly review those offering documents.

The fund is not guaranteed to generate quarterly distributions at the annualized rate set forth herein. The distribution target set forth herein is used for measurement or comparison purposes and only as a guideline for investors to evaluate the fund’s investment strategies and accompanying information. The targeted distribution set forth herein reflects subjective determinations by Alphaledger Investment Management LLC (“ALIM”) based on a variety of factors, including, among others, investment strategy, prior performance of similar products and strategies (if any), volatility measures, risk tolerance, and market conditions. Targeted distributions are not intended to be actual performance and should not be relied upon as an indication of actual or future performance of the fund. ALIM’s beliefs and assumptions may or may not prove to be correct and there can be no assurance that any such targets are attainable or will be realized, and actual results may vary materially, and include the possibility that, an investor therein may lose some or all of its invested capital.

The interests in the fund have not been registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or any state securities laws or the laws of any non-U.S. jurisdiction. It is anticipated that any offering and sale of the interests in the fund will be made only to investors that qualify as “accredited investors” within the meaning of Rule 501(a) under the Securities Act. An investment in the fund involves a high degree of risk, including possible loss of value, and is suitable only for sophisticated investors. The statements herein are subject to change at any time at ALIM’s sole discretion, and ALIM is not obligated to revise or update any statements herein for any reason or to notify recipients of any such change, revision, or update.

Alphaledger Markets, Inc. (“ALM”), a subsidiary of Alpha Ledger Technologies, is not serving as broker dealer for the fund or otherwise providing broker dealer services in connection with the fund’s offering of units to investors. ALM will not act as placement agent, underwriter, selling agent, custodian, or otherwise participate in the distribution of the units, and will not solicit, recommend, or arrange for the purchase or sale of units. Accordingly, (i) ALM will not be involved in the distribution of units, (ii) an account will not be opened with ALM, (iii) ALM will not otherwise have custody of fund assets, and (iv) SIPC protections will not apply with respect to an investment in the Fund. Check the background of this firm on FINRA's BrokerCheck.

Certain individuals who serve as officers of ALIM may also be officers of ALM. These individuals will receive no incentive allocation, placement fee, sales commission, or other transaction-based compensation from the fund or the investment manager in connection with the initial distribution of the units.