SurancePlus Inc.

SurancePlus, a subsidiary of NASDAQ listed Oxbridge Re, has an established track record and offers access to a structured alternative investment opportunity with a targeted annual return of 20%. Committed to transparency and regulatory compliance, SurancePlus operates under rigorous oversight and aligns with U.S. securities laws.

Through its affiliation with Oxbridge, SurancePlus leverages more than a decade of experience in the reinsurance industry to deliver thoughtfully structured investment opportunities that were historically available only to ultra-high-net-worth investors.

View the SurancePlus high-yield offering.

● Offering Details

T20:2027 - Balanced-Yield Strategy Tokenized Reinsurance

Security

| Company | A Subsidiary of Oxbridge Re (NASDAQ: OXBR) |

| Description | Tokenized Reinsurance Security |

| Target ROI | 20% annually |

| Pricing | $10 per share. See details for discount eligibility. |

| Annual Contract Term | June 1, 2026 - May 31, 2027 |

| Subscription Window | Subscribe by March 31, 2026 |

| Investor Eligibility | U.S. (Accredited) and Non-U.S. |

| Offering | Reg D (U.S.), Reg S (Non-U.S.) |

| Minimum Investment | $5,000 for individuals, $50,000 for entities |

| Transfer Restrictions | Subject to Reg D and Reg S requirements |

| Value Transfer | USD or Stablecoin (USDC) |

| Fees | 2% / 20% |

| Tokenization Engine | Vulcan Forge by Alphaledger Technologies, Inc. |

| Network | Exclusively on Solana |

Information displayed above is provided for informational purposes only and is subject to change without notice.

Highlights

SurancePlus Target 20% Participation Shares 2027 (T20:2027) is a Real-World Asset (RWA) backed security, compliant with U.S. Securities law, that has been digitized to provide easier access to investors.

Transparency and Compliance

Transparency and Compliance

SurancePlus is a subsidiary of Oxbridge Re (NASDAQ: OXBR), a publicly traded company audited in accordance with Public Company Accounting Oversight Board (PCAOB) standards.

Asset-backed

Asset-backed

The assets backing the security are fully collateralized reinsurance contracts underwritten by Oxbridge’s regulated reinsurance subsidiaries.

Complies with U.S. Securities Laws

Complies with U.S. Securities Laws

The T20:2027 tokenized reinsurance security will be offered and sold to U.S. investors in compliance with exemptions from registration provided under United States securities laws.

Attractive Projected ROI

Attractive Projected ROI

The T20:2027 tokenized reinsurance security is designed to offer investors a targeted annual return of 20% in year one.

How it works

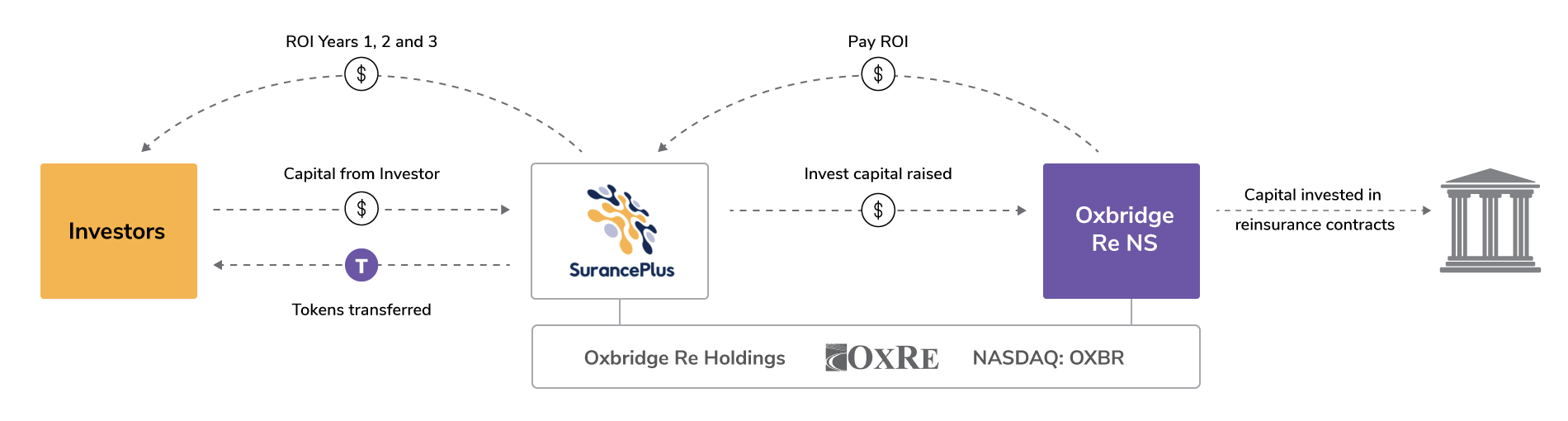

Minimum investment amounts start at $5,000 for individuals and $50,000 for entities, providing access to a structured reinsurance investment opportunity.

When you invest, your capital is pooled with other investors and held in segregated trust accounts at U.S. banks.

Refer to the PPM to learn more about how licensed reinsurer Oxbridge Re NS deploys the capital received from SurancePlus in reinsurance contracts.

Target 20% Participation Shares 2027

SurancePlus Inc. (“SurancePlus”) is a Web3-focused subsidiary of NASDAQ-listed Oxbridge that specializes in Real-World Asset (“RWA”) tokenization.

SurancePlus believes its Tokenized Reinsurance Securities represent the first on-chain reinsurance real-world assets of their kind to be sponsored by a subsidiary of a publicly traded company. The real-world assets backing the securities are reinsurance contracts.

The SurancePlus Target 20% Participation Shares 2027 token targets a 20% annual return, subject to no insured losses.

What is Reinsurance?

At its core, reinsurance is a $750 billion global industry that provides insurance for insurance companies. Insurers purchase reinsurance to help manage risk associated with catastrophic events, such as hurricanes, that could otherwise result in significant losses or threaten their financial stability.

Examples of leading global reinsurers include Berkshire Hathaway, Lloyd’s of London, and Swiss Re.

Through Oxbridge, SurancePlus provides access to a high-return alternative investment opportunity uncorrelated with broader public equity markets.

● About Us

Leadership

Jay Madhu, CEO

Chairman, CEO & Director of Oxbridge Re (NASDAQ: OXBR) | President of SurancePlus

Jay serves as Chairman of the Board, Chief Executive Officer and President of Oxbridge Re Holdings (NASDAQ: OXBR), as well as its licensed reinsurance subsidiaries and its Web3 startup SurancePlus that democratizes reinsurance contracts by issuing digitized securities. Jay is also a founder, Chairman and President of Oxbridge Acquisition Corp. (NASDAQ: OXAC) and founder/director of HCI Group (NYSE: HCI).

Mr. Madhu has a diverse background in insurance, banking and real estate, and has held various executive positions at NYSE listed HCI Group, Inc., specializing in marketing and investor relations. He was also a past board member of BayFirst Financial Corp (NASDAQ: BAFN) a bank holding company. He is an approved director with several monetary authorities and insurance departments, including the Cayman Islands Monetary Authority, Bermuda Monetary Authority, and Florida Office of Insurance Regulation, among many others.

Wrendon Timothy

CFO & Director of Oxbridge Re (NASDAQ: OXBR) | Director of SurancePlus

Wrendon serves as a director of SurancePlus and Oxbridge Re and has been Chief Financial Officer (CFO) and Corporate Secretary of Oxbridge Re since August 2013. He also serves as a director for the company’s licensed reinsurance subsidiaries. Mr. Timothy is a founder, director and CFO of Oxbridge Acquisition Corp (NASDAQ: OXAC) and has over 19 years combined Big 4 (PwC & KPMG) and industry professional experience in the fields of technical and SEC reporting, compliance, internal and external auditing, corporate governance, mergers and acquisitions analysis, risk management, and CFO and controller services.

Mr. Timothy is a Fellow of the Association of Chartered Certified Accountants (ACCA), a Fellow Chartered Secretary (FCG) and also holds a Master of Business Administration, with Distinction (with a Specialism in Finance), from Heriot-Watt University in Edinburgh, Scotland.

Drew Madhu

Chief Business Development Officer & Head of Strategic Partnerships of SurancePlus

Drew serves as Chief Business Development Officer and Head of Strategic Partnerships at SurancePlus, where he leads global business development, strategic partnerships, and market expansion. Prior to joining SurancePlus, Drew served as Head of Autonomous Driving Sales, North America at Hesai Technology (NASDAQ: HSAI), the world’s leading LiDAR manufacturer. In this role, he played a key role in scaling U.S. and European sales operations and building strategic relationships with major global automotive partners. Drew previously served as an Advisory Board Member of Oxbridge Acquisition Corp., a $115 million SPAC. Earlier in his career, he held senior business development roles at Quanergy, managing sales across the Americas, Middle East, Africa, and India. He began his career in Venture Capital, serving as a Summer Investment Team Associate at Highland Capital Partners and Rothenberg Ventures. Drew earned a Bachelor of Arts from Stanford University, where he was a Varsity Football Scholar Athlete and Rose Bowl Champion.

Disclaimer

The information contained herein may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of SurancePlus Inc. (“SurancePlus”). The information referenced herein is provided for informational purposes only and is subject to change.

The information is not an offer, or solicitation of an offer, in respect of an investment in SurancePlus. This information is being provided to you solely for discussion purposes and may not be used or relied on for any purpose (including, without limitation, as legal, tax or investment advice). If any offer and sale of tokenized reinsurance securities of SurancePlus is made, it will be pursuant to the confidential private placement memorandum (the “PPM”). Any decision to make an investment in the tokenized reinsurance securities of SurancePlus should be made after reviewing such PPM, conducting such investigations as the investor deems necessary and consulting the investor’s own investment, legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment.

Certain statements reflect the views, estimates, opinions, or predictions of SurancePlus regarding its business, and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. Certain information provided herein is sourced from third parties. Such information has not been independently verified by SurancePlus, and SurancePlus does not assume responsibility for the veracity of such information. None of SurancePlus or its shareholders, directors, executives, affiliates or subsidiaries makes any representation or warranty, express or implied, as to the accuracy or completeness of any information herein or made available to you.